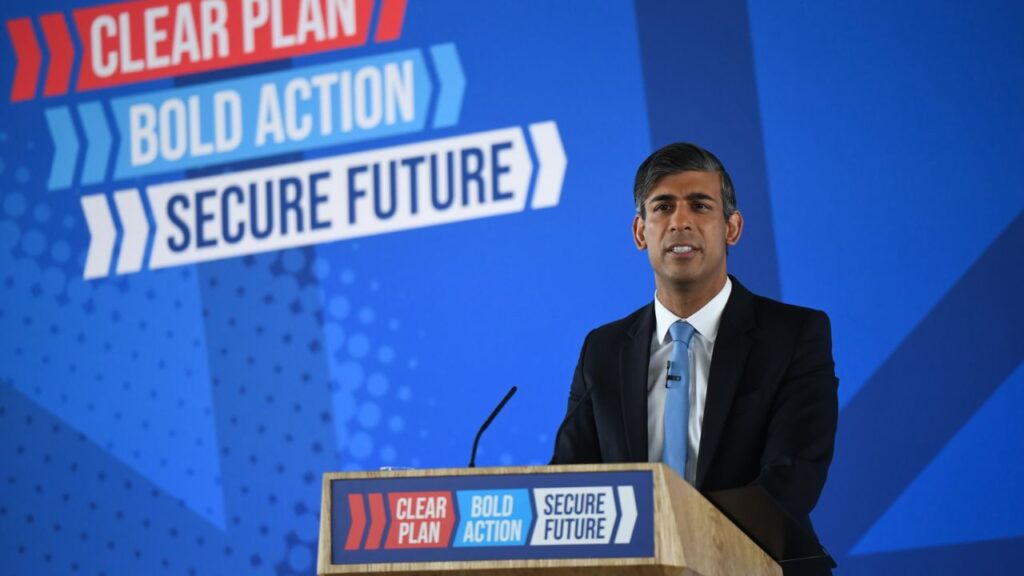

Conservative Manifesto 2024: The Conservative Party’s general election 2024 manifesto has been unveiled by Rishi Sunak.

Table of Contents

The document includes proposals to further reduce national insurance during the upcoming Parliament, following two discrete 2p cuts this year.

In the event that the Conservatives are re-elected at the national poll on July 4, there are also plans to implement a state pension triple lock plus and reform child benefit.

Prospective electors are confronted with additional challenges in addition to the giveaways. Jeremy Hunt has verified that income tax thresholds will remain unchanged in the event of an effective tax increase. This is in stark contrast to the pledges made by the Lib Dems and Reform UK.

Therefore, the Conservative manifesto could have a significant impact on your financial situation if the party manages to surpass current expectations and maintains its position in power.

A distinct article has been published regarding the potential implications of a Labour government on your financial situation.

What effects will the Conservative manifesto 2024 have on Taxes?

According to the Conservative manifesto, over £17 billion will be saved in tax by 2029/30, with National Insurance being scrapped and reduced to 6%.

By the end of the Parliament, the main rate of class 4 self-employed national insurance will be abolished, as well as a 2p cut to the levy by April 2027.

The 2024 Conservative manifesto makes the same promises on tax and immigration that it made in 2019, 2017, 2015 and 2010. Don’t believe a single word of it.

— Nigel Farage MP (@Nigel_Farage) June 11, 2024

There are also plans not to raise income tax or VAT rates, changes to child benefit for high earners, and a crackdown on tax avoidance and evasion to raise £6bn by 2029/30.

Jeremy Hunt’s ‘family home tax guarantee’ is included in the manifesto, which would prevent council tax bands from increasing, revaluations from occurring, or council tax discounts from being removed.

Also Read: Chapter 35 VA Benefits Pay Scale 2024: Check out how much you’ll get

Conservative manifesto 2024: Public Finance

The Conservative Party has “repaired” the UK’s public finances during its 14-year tenure in office, according to Rishi Sunak’s manifesto..

The Conservatives’ strict fiscal policies will persist if they are re-elected, despite the fact that the manifesto implies that the decline in national debt and borrowing is attributable to Covid-19.

The manifesto’s objective is to reduce public sector net debt and borrowing to below 3% of GDP by the conclusion of the decade.

In order to accomplish this, the party would implement welfare reforms that amount to £12 billion annually and nearly £6 billion in government efficiency savings.

Welfare reforms encompass the restriction of unfit assessments, the tightening of the sick note procedure, and the delegation of authority to the Department for Work and Pensions to combat benefit fraud.

Also Read: VA Disability Benefits: Eligibility And 23 Presumptive Conditions You Need to Know

What effects will the Conservative manifesto 2024 have on Pensions and savings?

The “Pensions Tax Guarantee” is a commitment by the Conservatives to preserve the triple lock and refrain from implementing new pension taxes.

They will continue to provide a 25% tax-free cash sum and maintain tax relief on pension contributions at their marginal rate.

The Parliamentary and Health Service Ombudsman (PHSO) report, which recommended £10.5bn in compensation for afflicted women, is currently being reviewed by the party.

The Conservatives have pledged to provide a prompt and appropriate response to the report. The manifesto does not include any new commitments to investors or consumers, and it does not mention the British ISA, which might indicate its future. Nevertheless, a novel initiative to combat fraudsters will be implemented.

Effects on Real Estate

The Conservatives have committed to maintaining the current stamp duty thresholds for first-time buyers (FTBs), which will exempt them from paying property tax on residences priced at up to £425,000.

Additionally, they intend to implement temporary capital gains tax relief for landlords who are selling to their current tenants.

The party also intends to revamp Help to Buy by offering FTBs an interest-free equity financing of up to 20% toward the cost of a new build, with only a 5% deposit required.

The mortgage guarantee scheme, which Labour intends to broaden through its Freedom to Buy initiative, will remain in effect.

The Renters Reform Bill and the Leasehold Reform Bill, which were either lost or reduced down in the aftermath of the election announcement, are to be revived by the party.

The Conservatives intend to construct 1.6 million dwellings in England if they are re-elected, which is 100,000 more than Labour has committed to.

Also Read: COLA Increase 2025 Predictions: Social Security benefit is going up by 2.6%