Atal Pension Yojana (APY) was also known as Swavalamban yojana earlier. This is a pension scheme funded by the government of India targeted towards unorganized sector workers of India. In 2015 finance minister Arun Jaitley talked about this scheme in his budget speech. Later prime minister Narendra Modi launched it in 2015 itself. The aim is to provide benefits to the unorganized sector.

Table of Contents

Atal Pension Yojana (APY) History

Earlier in Swavalamban yojana, accounts opened under the National pension scheme were a must have. In that, accounts opened between 2010-11 were eligible for the scheme. Subscribers should deposit a minimum of 1000 rupees and a maximum of 12000 rupees per annum. The government will contribute 1000 rupees for the next three years.

Later this scheme was changed to Atal pension yojana where a person aged less than 40 years can open an account and in accordance with the contribution made by them throughout the time will make them eligible for pension money after retirement.

Atal Pension Yojana (APY) Objective

Promote Social Security: The primary objective of the Atal Pension Scheme is to promote social security among the working population in the unorganized sector. It seeks to ensure that individuals have access to a regular and fixed pension amount after they retire, enabling them to lead a dignified life and meet their basic needs.

Encourage Voluntary Pension Savings: The scheme aims to encourage individuals to save for their retirement by offering them a pension plan with attractive features and benefits. It provides a platform for workers in the unorganized sector to contribute towards their retirement savings and secure their financial future.

Inclusion of Unorganized Sector Workers: The Atal Pension Scheme aims to include workers from the unorganized sector, who typically do not have access to formal pension plans or social security benefits. By providing a pension scheme specifically tailored for them, the government seeks to bridge the gap and ensure that even individuals in the unorganized sector can enjoy the benefits of a pension after their retirement.

Financial Inclusion: The scheme also aims to promote financial inclusion by encouraging individuals to open a bank account and avail the benefits of direct benefit transfer for their pension contributions. This helps in fostering a culture of savings and brings the unorganized sector workers into the formal financial system.

Pension Coverage: The objective of the Atal Pension Scheme is to expand the pension coverage in India. By offering a low-cost and easily accessible pension plan, the scheme intends to increase the number of individuals covered under a formal pension system, thereby reducing the dependency on the family and government support during old age.

Government Support: The scheme aims to provide a co-contribution from the government to eligible individuals, thereby incentivizing them to participate and contribute regularly to the pension scheme. This support ensures that individuals receive a minimum guaranteed pension amount based on their contributions and age at the time of joining the scheme.

In conclusion, the Atal Pension Scheme has multiple objectives, including promoting social security, encouraging voluntary pension savings, inclusion of unorganized sector workers, financial inclusion, expanding pension coverage, and providing government support. By addressing the retirement concerns of individuals in the unorganized sector, the scheme aims to provide them with a secure and dignified life after their working years.

Atal Pension Yojana (APY)Purpose?

- Decrease in the potential of earning at an older age.

- Pension provides a way to live a dignified life.

- Rise in cost of living.

- Makes the elderly more self dependent.

- Rewards the individual for the contributions they made in their lives.

- Promotes equality among organized sectors and unorganized sectors.

Atal Pension Yojana Features

- Pension Amount: Depending on the subscriber’s age and the amount of contributions made, the pension amount under the APY plan ranges from Rs. 1,000 to Rs. 5,000 per month.

- Age Restrictions: Participants in the APY scheme must be at least 18 years old and not older than 40 years. For the subscriber to be eligible for the pension, they must have made contributions to the plan for at least 20 years.

- Premium Payment: Subscribers must make contributions to the plan up until the age of 60. The amount of the contribution is determined by the pension amount chosen and the subscriber’s age. The monthly contribution ranges from as little as Rs. 42 for a pension of Rs. 1,000 to as much as Rs. 210 for a pension of Rs. 5,000

- Pension Start Date: The pension under the plan will start when the subscriber turns 60 years old, and they will continue to receive it for the remainder of their lives.

- The candidate for the pension in the event of the subscriber’s death may be their spouse or another member of their family.

Atal Pension Yojana Benefits

- Guaranteed pension: Following retirement, subscribers to the APY plan are given a monthly and guaranteed pension. The subscribers’ long-term financial security and stability are ensured by this.

- Low premium: The APY plan has a relatively cheap premium, making it accessible to subscribers in the unorganized sector.

- Tax advantages: Section 80C of the Income Tax Act provides tax advantages for contributions made to the APY plan.

- Social security: Subscribers who are not protected by another social security programme might get social security through the APY programme.

Atal Pension Yojana (APY) Eligibility

To be eligible for the Atal Pension Scheme (APS), individuals need to fulfill the following criteria:

Age: The scheme is open to all Indian citizens between the ages of 18 and 40 years. Individuals must fall within this age bracket at the time of joining the scheme.

Savings Bank Account: Individuals must have a savings bank account in any bank. The bank account will be used for the deduction of the contribution amount and for disbursing the pension amount.

Aadhaar Card: It is mandatory for individuals to have an Aadhaar card. The Aadhaar number will serve as a unique identifier for enrolling and availing the benefits of the scheme.

Not covered under other pension schemes: Individuals who are already covered under any statutory social security scheme like the Employees’ Provident Fund (EPF) or the National Pension Scheme (NPS) are not eligible to enroll in the Atal Pension Scheme.

Income Tax Payers: Individuals who are income tax payers are not eligible for the scheme.

It’s important to note that the Atal Pension Scheme primarily targets individuals working in the unorganized sector who do not have access to formal pension schemes. Therefore, individuals working in the organized sector are generally not eligible to join the scheme.

To enroll in the Atal Pension Scheme, individuals need to visit their bank or financial institution where they hold a savings bank account and provide the necessary documents, such as their Aadhaar card and bank account details, to complete the enrollment process.

Government Contribution In Atal Pension Yojana

The co-contribution of the Government of India is available for subscribers who join the plan between 1 June 2015 and 31 March 2016 and who are not covered by any Statutory Social Security Plan and are not income taxpayers for 5 years, i.e., from the Financial Year 2015-16 to 2019-20.

After receiving confirmation from the Central Record Keeping Agency that the subscriber has paid all of the installments for the year, the Pension Fund Regulatory and Development Authority (PFRDA) will pay the government co-contribution to eligible Permanent Retirement Account Numbers (PRANs). The government co-contribution will be credited in the subscriber’s savings bank account or post office savings bank account for up to 50% of the total contribution. The recipients of statutory social security benefits are not qualified to receive government contributions under APY.

How to Enroll in Atal Pension Yojana?

Enrollment in the APY programme is easy and can be completed at any bank branch or post office. The subscriber must fill out the APY registration form and supply information for their Aadhar card, bank account, and nominee. In accordance with their age and income, the subscriber must also select a pension amount and a contribution amount. A confirmation message will then be sent to the subscriber’s registered mobile number.

How to Open Atal Pension Yojana Account?

The Atal Pension Yojana (APY) is a government-backed pension scheme in India that aims to provide a sustainable pension to citizens in the unorganized sector. If you are eligible and interested in opening an APY account, here’s a step-by-step guide to help you through the process.

Eligibility Check: Before proceeding, ensure that you meet the eligibility criteria for the Atal Pension Yojana. The scheme is available to all Indian citizens aged between 18 and 40 years who have a savings bank account and an Aadhaar card. Make sure you fall within this age bracket and have the necessary documents.

Select a Bank: The APY can be opened through participating banks. Check with your bank if they offer the Atal Pension Yojana. Several public and private sector banks are authorized to open APY accounts, including State Bank of India (SBI), ICICI Bank, HDFC Bank, and others.

Visit the Bank: Once you have identified a bank that offers the Atal Pension Yojana, visit the branch where you hold your savings bank account. Approach the bank’s customer service or designated officer responsible for opening APY accounts.

Application Form: Request an APY application form from the bank. Fill out the form with accurate and complete information. The form will require details such as your name, address, contact information, Aadhaar number, bank account details, and nomination details. Ensure all the information provided is correct.

Provide Necessary Documents: Along with the filled application form, you will need to submit certain documents for verification. Typically, the required documents include your Aadhaar card, bank account proof (passbook, statement, or canceled cheque), and age proof (birth certificate, school certificate, etc.). Carry both the original and photocopies of the documents.

Contribution and Pension Amount Selection: The APY requires regular contributions based on the pension amount you desire. The pension amounts range from Rs. 1,000 to Rs. 5,000 per month, depending on your age and desired pension. Choose the pension amount you wish to receive after retirement and accordingly determine the monthly contribution. The bank executive will guide you in selecting the appropriate contribution amount.

Consent and Authorization: Carefully read the terms and conditions of the Atal Pension Yojana. Provide your consent and authorization by signing the application form and any other required documents.

Enrollment Acknowledgement: After submitting the application and documents, the bank will provide you with an acknowledgment receipt or a confirmation of enrollment. Keep this document safe for future reference.

Bank Account Setup: If you don’t have a savings bank account with the bank, you may need to open one. Follow the bank’s procedures for opening a new account, if necessary, and complete the account setup process.

Regular Contribution: Once your APY account is successfully opened, ensure that you make regular contributions on the specified due dates. The contribution will be automatically deducted from your linked savings bank account. It is crucial to maintain sufficient funds in the account to avoid any issues with the contribution process.

By following these steps, you can open an Atal Pension Yojana account and take a significant step towards securing your financial future. The APY provides a structured pension plan for individuals in the unorganized sector, ensuring a regular income during their retirement years.

How to Download Atal Pension Yojana (APY) Form

If you are interested in enrolling in the Atal Pension Yojana (APY) and need to download the APY form, here’s a step-by-step guide to help you through the process:

Open a Web Browser: Launch a web browser on your computer or mobile device. Ensure you have a stable internet connection to proceed with the download.

Search for Official Website: Use a search engine to find the official website of the Atal Pension Yojana. The website is maintained by the Pension Fund Regulatory and Development Authority (PFRDA), the governing body for APY. Look for the official government website to ensure you have the correct and authentic source.

Access the Downloads Section: Once you are on the official APY website, navigate to the “Downloads” or “Forms” section. This section typically contains all the necessary forms and documents related to the scheme.

Locate the APY Form: Within the Downloads section, search for the specific form required for opening an APY account. The form is usually titled “Atal Pension Yojana Application Form” or something similar. It may be available in PDF or Word format.

Download the Form: Click on the download link or button provided next to the APY form. This will initiate the download process. The form will be saved to your computer or mobile device, depending on your browser settings.

Verify the Downloaded File: Once the download is complete, locate the downloaded file on your device. Ensure that the file matches the correct APY form by comparing the title and the content with the official description provided on the website. This helps ensure that you have downloaded the genuine and up-to-date form.

Open and Print the Form: After verifying the file, open it using a suitable application such as Adobe Acrobat Reader or any other PDF reader. Review the form to familiarize yourself with its sections and requirements. If you have access to a printer, print a hard copy of the form. Alternatively, you can also fill out the form digitally by typing directly into the PDF file.

Complete the Form: Fill out the APY form with accurate and complete information. Provide details such as your name, address, contact information, Aadhaar number, bank account details, and nomination details, as required. Double-check the information for any errors or omissions before proceeding.

Attach Supporting Documents: Along with the completed form, gather any supporting documents required for the enrollment process. These may include your Aadhaar card, age proof, and bank account proof. Ensure that you have photocopies of the documents ready for submission.

Submit the Form: Take the duly filled APY form and the supporting documents to the nearest bank branch participating in the Atal Pension Yojana. Submit the form and documents to the bank representative responsible for APY enrollment. They will guide you through the further process, including verification and account setup.

By following these steps, you can easily download the APY form from the official website, fill it out accurately, and initiate the enrollment process for the Atal Pension Yojana. Remember to consult the official government website for the most updated and authentic form.

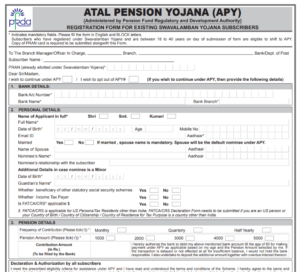

Atal Pension Yojana Form Sample

How to Fill Atal Pension Yojana Application Form

The Atal Pension Yojana (APY) is a government-initiated pension scheme in India that aims to provide financial security to individuals in the unorganized sector during their old age. If you are interested in enrolling in the APY and need assistance with filling out the application form, here is a step-by-step guide to help you through the process.

Obtain the Application Form: The Atal Pension Yojana application form is available at participating banks or can be downloaded from the official website of the scheme. Visit your nearest bank branch or access the official website to obtain a copy of the APY application form.

Personal Details: Start by filling in your personal information in the designated sections of the form. Provide accurate details such as your full name, date of birth, gender, and residential address. Ensure that the information matches the details mentioned in your Aadhaar card.

Contact Information: Enter your contact details, including your mobile number and email address. Double-check the accuracy of these details as they will be crucial for future communications and updates regarding your APY account.

Bank Account Information: In the next section, provide your bank account details. Include the name of your bank, branch, and the account number where you want the APY contributions to be deducted from and the pension amount to be credited.

Nomination Details: The APY form includes a section for nomination details. Fill in the name and relationship of the nominee who will receive the pension benefits in case of your unfortunate demise. Ensure that the nominee is aware of their role and responsibilities.

Contribution Amount Selection: The APY form provides options for selecting your desired pension amount. The pension amounts range from Rs. 1,000 to Rs. 5,000 per month, depending on your age at the time of enrollment. Choose the pension amount that suits your requirements and affordability.

Consent and Declaration: Carefully read through the terms and conditions of the Atal Pension Yojana and provide your consent by signing the declaration section. Ensure that you understand the implications of the scheme and the responsibilities of being an APY subscriber.

Supporting Documents: Along with the completed application form, attach the necessary supporting documents for verification. These documents typically include a self-attested copy of your Aadhaar card, age proof (such as a birth certificate or school certificate), and address proof (such as a utility bill or ration card). Make sure to include all required documents to avoid any delays in the application process.

Submission: Once you have filled in the APY application form and attached the supporting documents, submit the completed form to the designated authority at the bank branch where you obtained the form. The bank officials will guide you through the submission process and provide you with an acknowledgement receipt.

Regular Contributions: After your application is successfully processed and your APY account is opened, it is important to ensure regular contributions to the scheme. The contribution amount will be automatically deducted from your linked bank account on the specified due dates. Make sure to maintain sufficient funds in your account to avoid any disruptions in the contribution process.

By following these step-by-step instructions, you can successfully fill out the Atal Pension Yojana application form and initiate your journey towards a secure and dignified retirement. Remember to seek assistance from the bank officials or visit the official APY website for any additional guidance or clarifications.

How to Contribute to Atal Pension Yojana

The Atal Pension Yojana (APY) is a government-backed pension scheme in India that provides a guaranteed minimum pension to individuals in the unorganized sector. To avail the benefits of this scheme, it is essential to make regular contributions. If you are enrolled in the APY and want to know how to contribute, here is a step-by-step guide to help you through the process.

Determine the Contribution Amount: The first step is to determine the contribution amount you need to make towards your Atal Pension Yojana. The contribution amount depends on the pension amount you have chosen while enrolling in the scheme and your age at the time of joining. Refer to the APY contribution chart or consult your bank to ascertain the monthly, quarterly, or yearly contribution required.

Ensure Sufficient Balance: Ensure that you maintain sufficient balance in your linked savings bank account to cover the contribution amount. The contribution will be automatically debited from your account on the specified due dates. Failure to maintain sufficient funds may lead to non-compliance and a temporary suspension of your APY account.

Timely Contribution: Make sure to contribute the specified amount on time to avoid any penalties or discontinuation of the scheme. The due date for contributions is generally between the 1st and 10th of each month, depending on the frequency of contributions you have chosen.

Contribution Modes: The Atal Pension Yojana provides multiple modes for making contributions. The most common methods include auto-debit from your linked bank account, either through National Automated Clearing House (NACH) or through standing instructions provided to your bank. These modes ensure seamless and hassle-free contributions.

Auto-Debit Facility: To set up the auto-debit facility, visit your bank branch where you hold the linked savings bank account and provide a duly filled NACH mandate form or standing instruction form. These forms authorize the bank to deduct the specified contribution amount from your account on the designated due dates. Submit the form along with the necessary supporting documents, such as a canceled cheque or bank account details.

Maintain Contact Information: Keep your contact information updated with the bank to ensure that you receive regular communication regarding your contributions and the status of your APY account. Inform the bank in case of any changes in your mobile number, email address, or residential address.

Track Contributions: Periodically review your bank statements or passbook to track the contributions made towards your Atal Pension Yojana. This will help you monitor the regularity of your contributions and ensure that they are being deducted as per the specified amount and schedule.

Make Adjustments, if Required: If you wish to increase or decrease your contribution amount, you can do so once a year during the “APY Subscriber Declaration Form” submission process. Contact your bank and submit the necessary form to make adjustments to your contribution amount.

Seek Professional Advice: If you have any doubts or concerns regarding your contributions or the Atal Pension Yojana, it is recommended to seek guidance from a financial advisor or consult the bank officials. They can provide you with accurate information and assist you in managing your contributions effectively.

Opinion

This government-sponsored pension programme called Atal Pension Yojana seeks to give unorganized sector workers stability and financial security. At retirement, the plan offers a consistent, guaranteed pension to the subscribers. The scheme’s extremely low premium makes it accessible to subscribers in the unorganized sector. The programme offers social security to participants who are not covered by another social security programme. Consequently, the APY plan is a fantastic solution for unorganized sector workers to protect their financial security and secure their future.

Atal Pension Yojana (APY) Form Download

Atal Pension Yojana FAQs (Frequently Asked Questions)

Q: What is Atal Pension Yojana (APY)

A: Atal Pension Yojana is a government-initiated pension scheme in India that provides a fixed monthly pension to individuals in the unorganized sector. It aims to ensure social security and financial stability for individuals during their old age.

Q: Who is eligible to join the Atal Pension Yojana?

A: Any Indian citizen between the ages of 18 and 40 years can join the Atal Pension Yojana. They should have a valid savings bank account and an Aadhaar card.

Q: How does the Atal Pension Yojana work?

A: Under the Atal Pension Yojana, individuals make regular contributions towards their pension account. The pension amount depends on the chosen contribution amount and the age of the subscriber. Upon reaching the retirement age of 60, subscribers are eligible to receive a fixed monthly pension.

Q: How can I enroll in the Atal Pension Yojana?

A: To enroll in the Atal Pension Yojana, visit your nearest bank branch that offers the scheme. Fill out the application form, provide the required documents, and make the initial contribution. Once enrolled, regular contributions will be automatically deducted from your bank account.

Q: What are the contribution amounts and pension levels under the APY?

A: The contribution amounts range from Rs. 42 to Rs. 1,454 per month, depending on the chosen pension amount and the age of the subscriber at the time of enrollment. The pension levels vary from Rs. 1,000 to Rs. 5,000 per month.

Q: Can I increase or decrease my contribution amount?

A: Yes, you have the option to increase or decrease your contribution amount once a year during the “APY Subscriber Declaration Form” submission process. Contact your bank and submit the necessary form for any changes.

Q: Is there a penalty for late or missed contributions?

A: Yes, if you miss or delay your contributions, you may be charged a penalty. The penalty amount varies depending on the contribution amount and the duration of the delay.

Q: Can I exit the Atal Pension Yojana before the age of 60?

A: Premature exit from the scheme is allowed only in exceptional cases such as terminal illness or death. In such cases, the accumulated pension corpus will be returned to the subscriber’s nominee or legal heir.

Q: Can I switch my Atal Pension Yojana account from one bank to another?

A: Yes, it is possible to transfer your APY account from one bank to another. Visit the new bank where you wish to transfer your account and provide the necessary details and documents for the transfer process.

Q: Is the Atal Pension Yojana eligible for any tax benefits?

A: Contributions made towards the Atal Pension Yojana are eligible for tax benefits under Section 80CCD(1) of the Income Tax Act, up to a maximum of Rs. 1.5 lakh per financial year.

These FAQs aim to provide general information about the Atal Pension Yojana. For detailed and specific queries, it is advisable to consult the official website or visit the bank branch where you have enrolled in the scheme.